What is Hanging Man Pattern:

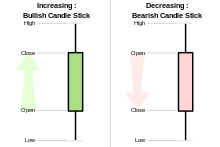

Hanging Man patteren aik bearish reversal candle stick ka namona hai jisay aam tor par zar e mubadla ke khredar bazaar mein sab se oopar ki salahiyat ko muntakhib karne ke liye istemaal karte hain. up trained ke khatmay par yeh namona kaghazi karwai aur is baat ke isharay ke salahiyat ka ulat jana qareeb araha hai. Hanging Man mein aik chhota sa haqeeqi frame hota hai jo mom batii ke chouti par aik taweel nichale saaye ke sath hota hai, jo aam tor par asal frame ki lambai se dugna hota hai. yeh taweel kami ka saya bazaar ke zariye ziyada qeematon ko mustard karne ki numaindagi karta hai, jis ki wajah se jazbaat mein salahiyat mein tabdeeli aati hai. tajir bazaar ke rastay mein taizi se mandi tak ke mutabadil ki tasdeeq ke liye is namoonay ki talaash karte hain, jis se inhen fori pozishnon mein daakhil honay ya mojooda taweel trading par munafe lainay ko zehen mein rakhnay ka ishara milta hai.

Key Characteristics of the Hanging Man Pattern:

Hanging Man patteren ki kaleedi khususiyaat mein se aik is ki ain mutabiq mom batii ki shakal hai, jis mein mom batii ke chouti par aik chhota haqeeqi frame aur aik lamba nichala saya shaamil hai. yeh nichala saya asal jism se neechay ki taraf barhta hai aur intra day ki kam tareen satah ki nishandahi karta hai jo tijarti session ke qareeb ki madad se juzwi tor par behtar honay se pehlay qeemat par qaboo panay se pehlay pahonch gayi thi. is lambay nichale saaye ki mojoodgi Hanging Man ko mukhtalif mom btyon ke namonon se mumtaz karne mein ahem hai, kyunkay is se market ke jazbaat mein taizi se mandi ki taraf salahiyat ki tabdeeli ka pata chalta hai.

Interpretation and Significance of the Hanging Man Pattern:

Jab Hanging Man kisi up trained ke tark honay par kaghazi karwai ka namona banata hai, to usay aik mandi ki alamat samjha jata hai jis se yeh zahir hota hai ke bazaar apni oopar ki raftaar kho raha hai. tajir is namoonay ki tashreeh is baat ki alamat ke tor par karte hain ke bail heera pheri kar rahay hain, aur reechh bhi jald hi qabza kar satke hain. lambay nichale saaye ka matlab yeh hai ke laagat ko ziyada badhaane ki koshish ke bawajood, baichnay walay qeemat ke back pedal ko taaqat dainay mein kamyaab rahay, taweel arsay mein iftitahi satah ke qareeb ya is se neechay band hue. ziyada akhrajaat ko mustard karna market mein mumkina kamzoree aur mumkina fashion ulat ko zahir karta hai, jis se kharidaron ko mukhtasir pozishnon ko yaad karne ya mojooda taweel pozishnon par nuqsaan ke marahil ko sakht karne ka ishara milta hai .

Confirmation and Trading Strategy with the Hanging Man Pattern:

Agarchay Hanging Man patteren ko pehchanana salahiyat ke fashion ke ulat palat mein qeemti baseerat faraham kar sakta hai, lekin kharidari aur farokht ki koi bhi harkat karne se pehlay tasdeeq ka intzaar karna bohat zaroori hai. traders Hanging Man ki sadaqat ki tasdeeq ke liye baad ki tijarti mushawarat mein baqaidagi se izafi isharay ya mashkook mom batii ke patteren ki talaash karte hain. yeh tasdeeq aik opening down, aik bearish patteren, ya Hanging Man ke asli frame ke neechay baqi aik tosiay gulaabii mom batii ki shakal mein aana chahay gi. aik baar Hanging Man dukhaay jane ke baad, sarmaya car rujhan ki had se ziyada nuqsaan ke sath fori pozishnon mein daakhil hona ya is ke nateejay mein apni khatray se nimatnay ki hikmat e amli ko tabdeel karna bhi nahi bhool satke hain .

Limitations and Considerations when Trading the Hanging Man Pattern:

Agarchay Hanging Man ka namona zar e mubadla bazaar ke andar salahiyat ke rujhan ke ulat palat ka pata laganay ke liye aik faida mand zareya ho sakta hai, lekin is ki rukawaton aur awamil par ghhor karna bohat zaroori hai jo is ki taseer ko mutasir karen ge. aik uljan jhutay isharay ka imkaan hai, kyunkay Hanging Man ke tamam namonon ke nateejay mein sharah mein bohat ziyada tabdeeli nahi aati hai. mazeed bar-aan, bazaar ke halaat, maloomat ke waqeat, aur mukhtalif bairooni anasir namona ki durustagi ko mutasir kar satke hain. taajiron ko –apne tijarti faislon ko behtar bananay aur mumkina nuqsanaat ko kam karne ke liye Hanging Man ke sath sath deegar takneeki tehqeeqi alaat aur khatray par qaboo panay ki hikmat amlyon ka istemaal karna chahiye .

Hanging Man patteren aik bearish reversal candle stick ka namona hai jisay aam tor par zar e mubadla ke khredar bazaar mein sab se oopar ki salahiyat ko muntakhib karne ke liye istemaal karte hain. up trained ke khatmay par yeh namona kaghazi karwai aur is baat ke isharay ke salahiyat ka ulat jana qareeb araha hai. Hanging Man mein aik chhota sa haqeeqi frame hota hai jo mom batii ke chouti par aik taweel nichale saaye ke sath hota hai, jo aam tor par asal frame ki lambai se dugna hota hai. yeh taweel kami ka saya bazaar ke zariye ziyada qeematon ko mustard karne ki numaindagi karta hai, jis ki wajah se jazbaat mein salahiyat mein tabdeeli aati hai. tajir bazaar ke rastay mein taizi se mandi tak ke mutabadil ki tasdeeq ke liye is namoonay ki talaash karte hain, jis se inhen fori pozishnon mein daakhil honay ya mojooda taweel trading par munafe lainay ko zehen mein rakhnay ka ishara milta hai.

Key Characteristics of the Hanging Man Pattern:

Hanging Man patteren ki kaleedi khususiyaat mein se aik is ki ain mutabiq mom batii ki shakal hai, jis mein mom batii ke chouti par aik chhota haqeeqi frame aur aik lamba nichala saya shaamil hai. yeh nichala saya asal jism se neechay ki taraf barhta hai aur intra day ki kam tareen satah ki nishandahi karta hai jo tijarti session ke qareeb ki madad se juzwi tor par behtar honay se pehlay qeemat par qaboo panay se pehlay pahonch gayi thi. is lambay nichale saaye ki mojoodgi Hanging Man ko mukhtalif mom btyon ke namonon se mumtaz karne mein ahem hai, kyunkay is se market ke jazbaat mein taizi se mandi ki taraf salahiyat ki tabdeeli ka pata chalta hai.

Interpretation and Significance of the Hanging Man Pattern:

Jab Hanging Man kisi up trained ke tark honay par kaghazi karwai ka namona banata hai, to usay aik mandi ki alamat samjha jata hai jis se yeh zahir hota hai ke bazaar apni oopar ki raftaar kho raha hai. tajir is namoonay ki tashreeh is baat ki alamat ke tor par karte hain ke bail heera pheri kar rahay hain, aur reechh bhi jald hi qabza kar satke hain. lambay nichale saaye ka matlab yeh hai ke laagat ko ziyada badhaane ki koshish ke bawajood, baichnay walay qeemat ke back pedal ko taaqat dainay mein kamyaab rahay, taweel arsay mein iftitahi satah ke qareeb ya is se neechay band hue. ziyada akhrajaat ko mustard karna market mein mumkina kamzoree aur mumkina fashion ulat ko zahir karta hai, jis se kharidaron ko mukhtasir pozishnon ko yaad karne ya mojooda taweel pozishnon par nuqsaan ke marahil ko sakht karne ka ishara milta hai .

Confirmation and Trading Strategy with the Hanging Man Pattern:

Agarchay Hanging Man patteren ko pehchanana salahiyat ke fashion ke ulat palat mein qeemti baseerat faraham kar sakta hai, lekin kharidari aur farokht ki koi bhi harkat karne se pehlay tasdeeq ka intzaar karna bohat zaroori hai. traders Hanging Man ki sadaqat ki tasdeeq ke liye baad ki tijarti mushawarat mein baqaidagi se izafi isharay ya mashkook mom batii ke patteren ki talaash karte hain. yeh tasdeeq aik opening down, aik bearish patteren, ya Hanging Man ke asli frame ke neechay baqi aik tosiay gulaabii mom batii ki shakal mein aana chahay gi. aik baar Hanging Man dukhaay jane ke baad, sarmaya car rujhan ki had se ziyada nuqsaan ke sath fori pozishnon mein daakhil hona ya is ke nateejay mein apni khatray se nimatnay ki hikmat e amli ko tabdeel karna bhi nahi bhool satke hain .

Limitations and Considerations when Trading the Hanging Man Pattern:

Agarchay Hanging Man ka namona zar e mubadla bazaar ke andar salahiyat ke rujhan ke ulat palat ka pata laganay ke liye aik faida mand zareya ho sakta hai, lekin is ki rukawaton aur awamil par ghhor karna bohat zaroori hai jo is ki taseer ko mutasir karen ge. aik uljan jhutay isharay ka imkaan hai, kyunkay Hanging Man ke tamam namonon ke nateejay mein sharah mein bohat ziyada tabdeeli nahi aati hai. mazeed bar-aan, bazaar ke halaat, maloomat ke waqeat, aur mukhtalif bairooni anasir namona ki durustagi ko mutasir kar satke hain. taajiron ko –apne tijarti faislon ko behtar bananay aur mumkina nuqsanaat ko kam karne ke liye Hanging Man ke sath sath deegar takneeki tehqeeqi alaat aur khatray par qaboo panay ki hikmat amlyon ka istemaal karna chahiye .

تبصرہ

Расширенный режим Обычный режим